Gain Access To Fixed Rate Investments From Across Australia At No Cost.

Get Connected To Some Of Australia’s Top Brokers Now.

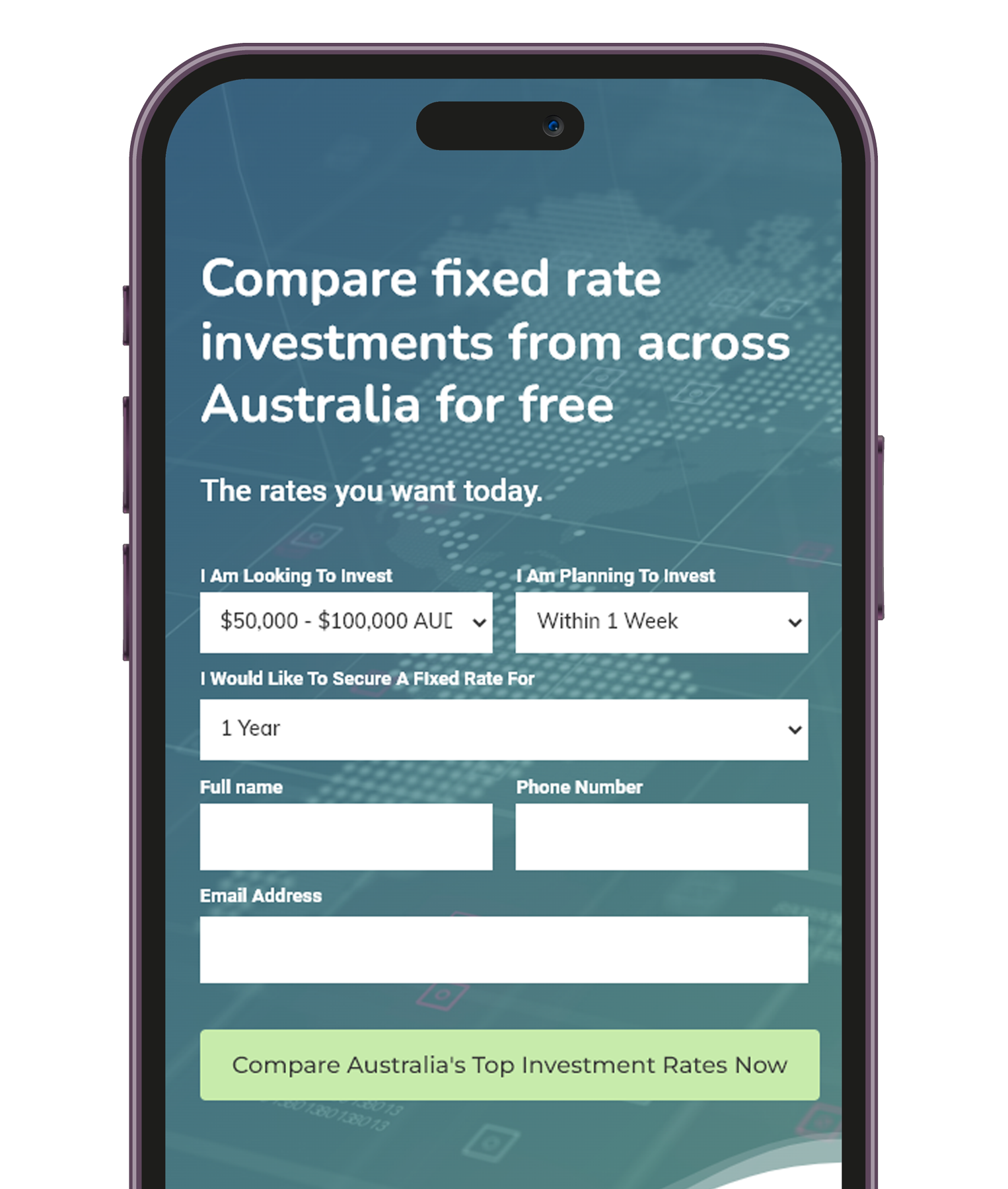

Complete the secure investor information form

Enter your details carefully in order to receive your broker consultation in an efficient and timely manner. All information provided is securely stored and only used to provide you with relevant information

Get connected to some of Australia’s top brokers, specialists in fixed term investments.

We connect Australian’s to specialist brokers with cutting edge information on the current best term deposit rates from across the country. Our service is completely free for you, the brokers in question pay us a small commission for introducing you to them.

Over 5000 people have used Financial-Guide.net to date to help them discover fixed return investments from specialist brokers across Australia.

Data Security

We understand how important your privacy is. That’s why we only pass your information on to relevant parties and never re-sell information.

Relevancy

No one likes their time to be wasted, that’s why we use the information you provide to make sure you only receive the most relevant contact.

WHY FIXED RETURN INVESTMENTS?

Term deposits offer safe and secure fixed interest rates. Compare term deposit rates today for free.

- Competitive, inflation beating fixed interest rates.

- No monthly account fees, commissions paid or application fee’s.

- Ideal investment for savers looking to beat their current term deposit rates.

- Rates of return from 5.6% – 7.5% per year.

- Deposits protected and insured, mitigating investor risk.

The Rates You Want. The Terms You Need.

*Example rates that brokers are currently offering

6.27%

PER ANNUM

12 MONTH TERM

A 12 month term deposit secures you a fixed interest rate for one year, allowing you to compare the markets for the best rates regularly.

6.92%

PER ANNUM

24 MONTH TERM

Simply want to lock your money away and forget about it? This is an example of a 2 year term deposit rate currently on offer.

7.34%

PER ANNUM

36 MONTH TERM

A 36 month term offers investors the highest annual rates on their savings, giving you long term financial security.

Get Connected To Australia's Best Fixed Term Brokers Today.

Securely enter your details today and join the hundred of happy customers that are finding their next investment – the smart way. Our service is completely free and you will be contacted by relevant brokers within 24 hours.

Disclosure

Please be advised that the content of this promotion is not authorized by any regulatory body and is not intended to constitute financial advice. Individuals who rely on this promotion for the purpose of engaging in any investment activity do so at their own risk and may expose themselves to a significant risk of losing all of their investment. Please note that this website is a paid promotion and is operated as a marketing website on behalf of third-party partners. The owners of this site assume no responsibility for any financial losses that may occur as a result of investing based on the content of this site. Additionally, the owners of this site cannot be held liable for any actions or advice provided by any third-party partners. Please note that there are no fees associated with using this service, and this website offers information on investment products provided by our partners. However, if you decide to invest, you do so at your own risk and under no obligation. If you are unsure about whether to invest, we strongly advise you to contact a regulated financial advisor. By using this website, you are bound by the terms set out in the privacy policy and terms & conditions. You agree to indemnify and hold harmless the website owner, its affiliates, and their respective officers, directors, employees, and agents from any and all claims, damages, and expenses (including reasonable attorneys’ fees) arising from your use of the website or any investment decisions made based on the content of this site or information given by third parties, the owners of this lead generation website have no connection to any of the investment products offered by third parties and accept no responsibility for any investment advice given.

Fees

There are no fees to use this service. This website offers information on investment products offered by our partners. Should you wish to invest this is at your risk you are under no condition to do.